491k Limit 2025 - Looking for the latest on 401(k) contributions in 2025? Roth 401 (k) contribution limits 2025. 401(k) Contribution Limits in 2023 Meld Financial, Employees can invest more money into 401 (k) plans in 2025, with contribution limits increasing from 2023’s $22,500 to $23,000 for 2025. In 2025, this rises to $23,000.

Looking for the latest on 401(k) contributions in 2025? Roth 401 (k) contribution limits 2025.

491k Limit 2025. The irs limits how much employees and employers can contribute to a 401 (k) each year. For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10% of.

The IRS just announced the 2025 401(k) and IRA contribution limits, If you are 50 years old or older, the maximum. Retirement savers are eligible to put $500 more in a 401 (k) plan in 2025:

For 2025, the limit for 401(k) plan contributions is $23,000, up from $22,500 last year, according to the irs.

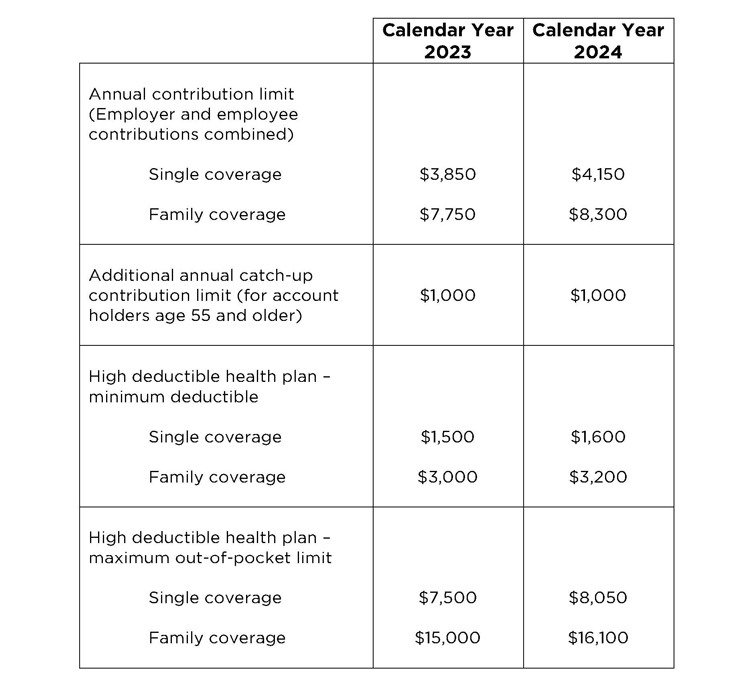

2025 HSA & HDHP Limits, The roth 401 (k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit will go up to $23,000 in 2025.

2023 Contribution Limits for Retirement Plans Fiduciary Financial, Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government's thrift savings plan can contribute up to $23,000 in 2025, a $500 increase. For tax years starting in 2025, an employer may make uniform additional contributions for each simple plan employee to a maximum of the lesser of up to 10% of.

New HSA/HDHP Limits for 2025 Miller Johnson, Irs releases the qualified retirement plan limitations for 2025: For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at.

401(k) Contribution Limits for 2025, 2023, and Prior Years, The 401 (k) contribution limit. Check out the shrm legalnetwork.

Read our write up on the current 401(k) contribution limits and what they mean for you.

The IRS announced its Roth IRA limits for 2025 Personal, Irs releases the qualified retirement plan limitations for 2025: While you can save quite a lot in a 401 (k) every year, you can't.

IRS Announces HSA Limits for 2025 Paysmart, Those 50 and older can contribute an additional $7,500 in 2023 and 2025. The 401 (k) contribution limit.